On the Principles of Gibraltar Taxation

Each chapter of On the Principles of Gibraltar Taxation describes and discusses a single principle which can be discerned in the design and operation of the Gibraltar taxation system.

- ForthcomingHardbackGBP 75.00 Pre-order

- AvailablePDF

GBP 75.00GBP 37.50 Add to basket

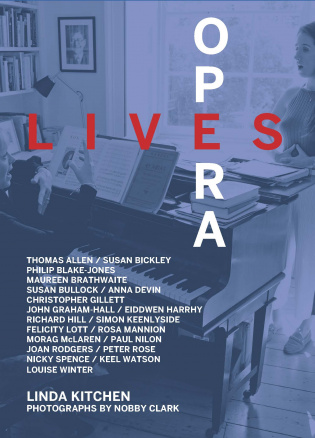

Opera Lives

WHAT MAKES AN OPERA SINGER?

And where in the making of a performance is the identity of the singer themselves?

Linda Kitchen goes behind the scenes with prominent voices who have valuable insight about the world of opera, discussing what it means to be a performer, how they got into the profession and how who they are affects how they perform.

Illustrated with photos of the artists in places that lend meaning to their lives by renowned photographer Nobby Clark.

Visit our Facebook page for more photos and information:

https://www.facebook.com/operalivesbook/

- AvailablePaperbackGBP 24.95 Add to basket

- AvailableHardbackGBP 45.00 Add to basket

- AvailablePDF

GBP 24.95GBP 12.47 Add to basket

A Practitioner's Guide To International Tax Information Exchange Regimes

DAC6, TIEAs, MDR, CRS, and FATCA

The sixth amendment to the Directive on Administrative Cooperation in the field of taxation (DAC6) and mandatory disclosure regimes (MDRs) in many jurisdictions have led to a large number of professionals potentially being required to disclose information in relation to their clients’ arrangements. The authors analyse the operation of the various automatic exchange of information regimes introduced in the last five years, including the OECD common reporting standards, DAC6 and MDRs, setting them in their historical context. They focus on the guidance offered by the Irish and UK tax authorities with reference to other guidance in Europe and beyond, where appropriate.

- AvailablePaperbackGBP 99.95 Add to basket

- AvailablePDF

GBP 99.95GBP 49.98 Add to basket

Private International Law of Corporations

This book is about the theory of corporations as subjects of private international law. It aims to show the true extent and depth of legal and jurisdictional problems that states commonly face now, dealing with allocation of cross-border corporate relations and other relations closely connected with them in the appropriate system of law and jurisdiction.

This book is a manual for jurists, practitioners of law and academics, who need research covering specific legal and jurisdictional issues in a corporate sphere and probes the issue of the place of private international law of corporations in national systems of law, when viewed through institutional, scientific, practical, strategic and economic dimensions.

- AvailablePaperbackGBP 29.95 Add to basket

- AvailablePDF

GBP 29.95GBP 14.97 Add to basket

Protected Cell Companies

A guide to their implementation and use

Protected Cell Companies is a valuable resource for practitioners who work with this important new business form. The book provides comprehensive guidance on such complex issues as insolvency, veil-piercing, tax, and accounting, use for captive insurance companies, and as a bankruptcy remote vehicle for special purpose vehicles, credit derivatives, and open-end investment companies.

- AvailablePaperbackGBP 99.95 Add to basket

- AvailablePDF

GBP 99.95GBP 49.98 Add to basket

Resolving Business Disputes

How to get better outcomes from commercial conflicts

Resolving Business Disputes will give company directors, business executives and other commercial decision-makers a unique and essential insight into how to resolve business disputes and to reach the best outcomes by making effective decisions. The book is a guide, explaining the unique choices created by commercial conflict, basic workings of the law about disputes, the main avenues of dispute resolution, the forecasting of litigation outcomes for cases going to court, the funding of legal cases, the management of the risk involved, the creation of a dispute strategy, how to make the best use of legal advice and how to negotiate effectively. Also covers implications of Covid-19 for trade and commerce, including issues for the resolution of contract disputes.

- AvailablePaperback

GBP 39.95GBP 19.98 Add to basket - AvailablePDF

GBP 19.95GBP 9.97 Add to basket

Six Tycoons

the lives of John Jacob Astor, Cornelius Vanderbilt, Andrew Carnegie, John D. Rockefeller, Henry Ford and Joseph P. Kennedy

John D Rockefeller. Cornelius Vanderbilt. Andrew Carnegie. John Jacob Astor. Henry Ford. Joseph P Kennedy.Even today, long after their deaths, the names of these six men continue to be associated with wealth and power.When they were alive, they dominated their worlds as fewmen had done before, and few have done since.

- AvailablePaperbackGBP 10.99 Add to basket

- AvailableHardbackGBP 18.95 Add to basket

- AvailablePDFGBP 9.95 Add to basket

Tax Due Diligence

This book is a practical guide to the very practical subject of Tax Due Diligence. It aims to show that tax due diligence is not a commodity by leading the reader through the tax due diligence process and explaining at each stage how to extract the maximum value from tax due diligence.

- AvailablePaperbackGBP 69.95 Add to basket

- AvailablePDF

GBP 69.95GBP 34.98 Add to basket

The Tax Schedule

A Guide to Warranties and Indemnities (fourth edition)

The Tax Schedule explains the underlying rationale of the key provisions of the tax schedule, and provides updated model long-form and short-form warranties and tax indemnities.

The purpose of the book is to explain and simplify issues for tax advisors involved in transactions of buying and selling companies and business, enabling negotiations between tax advisors to keep sight of the commercial reality of the transaction (a sale by a willing seller to a willing buyer). The purpose of the tax schedule is to determine where responsibilities and risks will lie following the completion of the transaction, as well as to re-examine a number of so-called ‘market practices’.

- AvailablePaperbackGBP 65.00 Add to basket

- AvailableHardbackGBP 100.00 Add to basket

- AvailablePDF

GBP 100.00GBP 50.00 Add to basket

The Taxation of Permanent Establishments

An International Perspective

This book's principal theme is the taxation of permanent establishments, taking as its starting point the OECD (Organisation for Economic Co-operation and Development) model convention on the avoidance of double taxation, and examining how the Indian courts and India's law-makers have interpreted the rules governing attribution of profits.

- AvailablePDF

GBP 75.00GBP 37.50 Add to basket

Taxation of Small Businesses 2023/2024

The Taxation of Small Businesses 2023-24 is a practical guide to all aspects of direct taxation of small businesses in one volume. It is ideal for sole practitioners and small partnerships, but will be a handy reference guide for all tax advisers. The book aims to give a clear explanation of the relevant legislation and practical advice on ways of minimising clients’ tax liabilities and warning against common pitfalls.

The sixteenth edition has been updated to incorporate changes as a result of the Finance Act 2023.

- AvailablePaperbackGBP 60.00 Add to basket

- AvailablePDF

GBP 60.00GBP 30.00 Add to basket

The Rise and Fall of the Freedman's Savings Bank

And its lasting socio-economic impact on Black America

The author tells the history of the Freedman’s Savings Bank, how it grew much too quickly, why it failed and the impact on Black America. The Freedman’s Bank offered a safe depository for formerly enslaved people, expanded quickly and gained millions in deposits – mostly ranging from $5 to $50. But inexperience and corruption doomed it to failure, costing may of the small depositors their savings.

- AvailablePaperbackGBP 19.95 Add to basket

- AvailablePDF

GBP 19.95GBP 9.97 Add to basket