The Glorification of Plunder

State, Power and Tax Policy

This book is about two things: tax and power.

This book explores the complex dynamics of the debates which inform tax policy, the interaction between tax and power and how power relations between various groups in society and between individuals and the state are manifested through tax system. This helps to explain why the rules, procedures and practices are all formulated to suit their interests of the most powerful groups in society.

- AvailablePaperbackGBP 19.95 Add to basket

- AvailablePDFGBP 9.99 Add to basket

Methodological issues in accounting research

Second edition

What is my theory? How do I choose a theory? Why and how should I employ a particular method for collecting the empirical data? This book helps address these questions. The principal aims of this second edition are (1) to update the chapters previously published in 2006 and (2) to introduce new chapters documenting recent developments in accounting research.

- AvailablePaperbackGBP 34.95 Add to basket

- AvailablePDFGBP 20.00 Add to basket

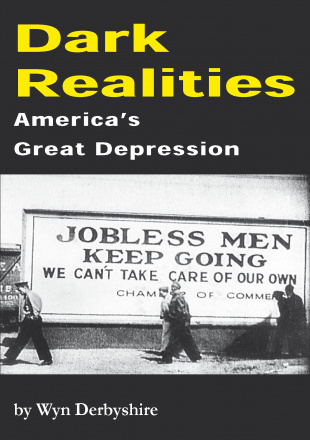

Dark Realities

America's Great Depression

This book covers the turbulent period of 1921 to 1942 in America's history, which went from the Roaring Twenties to the Great Depression and recovery via the New Deal. It introduces us to the key figures and reveals the impact which the Great Depression had on the American people.

Will be of value to GCSE, AS and A level history students looking for an accessible account of the Great Depression.

- AvailablePaperbackGBP 9.95 Add to basket

- AvailableHardbackGBP 17.95 Add to basket

- AvailablePDF

GBP 9.95GBP 4.97 Add to basket

A Decade of Armageddon

New Geography essays

This as-it-happened review of the causes, consequences, and repercussions of the 2008 Global Financial Crisis is more than a history lesson – it’s a look into the future.

These essays by Dr Susanne Trimbath, were first published between 2008 and 2015 on newgeography.com.

- AvailablePaperbackGBP 19.95 Add to basket

- AvailableHardbackGBP 39.95 Add to basket

- AvailablePDF

GBP 19.95GBP 9.97 Add to basket

The Tax Schedule

A Guide to Warranties and Indemnities (fourth edition)

The Tax Schedule explains the underlying rationale of the key provisions of the tax schedule, and provides updated model long-form and short-form warranties and tax indemnities.

The purpose of the book is to explain and simplify issues for tax advisors involved in transactions of buying and selling companies and business, enabling negotiations between tax advisors to keep sight of the commercial reality of the transaction (a sale by a willing seller to a willing buyer). The purpose of the tax schedule is to determine where responsibilities and risks will lie following the completion of the transaction, as well as to re-examine a number of so-called ‘market practices’.

- AvailablePaperbackGBP 65.00 Add to basket

- AvailableHardbackGBP 100.00 Add to basket

- AvailablePDF

GBP 100.00GBP 50.00 Add to basket

Six Tycoons

the lives of John Jacob Astor, Cornelius Vanderbilt, Andrew Carnegie, John D. Rockefeller, Henry Ford and Joseph P. Kennedy

John D Rockefeller. Cornelius Vanderbilt. Andrew Carnegie. John Jacob Astor. Henry Ford. Joseph P Kennedy.Even today, long after their deaths, the names of these six men continue to be associated with wealth and power.When they were alive, they dominated their worlds as fewmen had done before, and few have done since.

- AvailablePaperbackGBP 10.99 Add to basket

- AvailableHardbackGBP 18.95 Add to basket

- AvailablePDFGBP 9.95 Add to basket

On the Principles of Gibraltar Taxation

Each chapter of On the Principles of Gibraltar Taxation describes and discusses a single principle which can be discerned in the design and operation of the Gibraltar taxation system.

- ForthcomingHardbackGBP 75.00 Pre-order

- AvailablePDF

GBP 75.00GBP 37.50 Add to basket

In The Flow

Performance psychology for winning in canoeing and kayaking

What’s the connection between what paddlers think and feel and how they perform? How does mental preparation help performance? What do paddlers and their coaches need to do, to ensure paddlers perform at their best when it counts?

Former international paddler and now sport psychologist Jonathan Males combines his many years of experience working with successful competitors with recent research in this accessible book, designed to help paddlers and coaches understand the theory behind success and provide practical skills to improve performance.The importance of delivering the psychological fundamentals to achieve paddling success. What's the connection between what paddlers think and feel and how they perform? How does mental preparation help performance? What do paddlers and their coaches need to do, to ensure paddlers perform at their best when it counts? Former international paddler and now sport psychologist Jonathan Males combines his many years of experience working with successful competitors with recent research in this accessible book, designed to help paddlers and coaches understand the theory behind success and provide practical skills to improve performance.

Relevant for competitors in all disciplines as well as for recreational paddlers, In the Flow features chapters on self-confidence, decision-making, teamwork, whitewater paddling, competition and the joys of wilderness paddling.

To listen to a sample of the audiobook click here

- AvailablePaperbackGBP 17.00 Add to basket

- AvailablePDF

GBP 10.00GBP 5.00 Add to basket - AvailableDownloadable audio fileGBP 4.95

Charity Law Handbook

This is an indispensable collection of statutory and non-statutory materials relating to charity law in England and Wales. Revised to coincide with the implementation of the Charities Act 2011 – a major consolidation of the charity law - the Handbook is an essential reference source for charity lawyers, in-house lawyers, academics, charities and voluntary organisations and their trustees.

Available as three paperback volumes, CD-ROM or both (the mixed media option).

- AvailablePDF

GBP 99.95GBP 49.98 Add to basket

The Taxation of Permanent Establishments

An International Perspective

This book's principal theme is the taxation of permanent establishments, taking as its starting point the OECD (Organisation for Economic Co-operation and Development) model convention on the avoidance of double taxation, and examining how the Indian courts and India's law-makers have interpreted the rules governing attribution of profits.

- AvailablePDF

GBP 75.00GBP 37.50 Add to basket