On the Principles of Gibraltar Taxation

Each chapter of On the Principles of Gibraltar Taxation describes and discusses a single principle which can be discerned in the design and operation of the Gibraltar taxation system.

- ForthcomingHardbackGBP 75.00 Pre-order

- AvailablePDF

GBP 75.00GBP 37.50 Add to basket

Town and Parish Councils VAT Guide

Second edition

This Town and Parish Council VAT Guide is an easy reference guide for those engaged in administering the financial affairs of town and parish councils in England and community councils in Wales. It focuses on the typical range of activities that these local authorities will have. It will be of use to town and parish clerks or treasurers and those responsible for the book-keeping of these organisations, as well as those responsible for auditing such bodies. The authors give the reader the basic concepts of the tax and a degree of familiarity with the common technical terms used by H M Revenue and Customs (HMRC) in its own guidance. The most common terms are set out in the glossary.

This second edition includes updated commentary on the VAT treatment election administration, local authority supplies of sports and recreational facilities, and the secondment (supply) of staff.

- ForthcomingPaperbackGBP 39.95 Add to basket

- AvailablePDF

GBP 39.95GBP 19.98 Add to basket

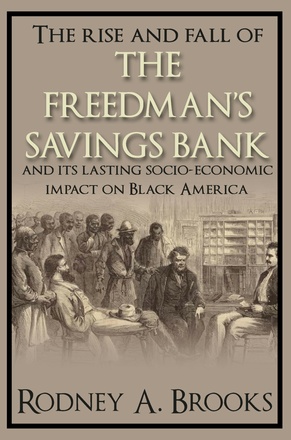

The Rise and Fall of the Freedman's Savings Bank

And its lasting socio-economic impact on Black America

The author tells the history of the Freedman’s Savings Bank, how it grew much too quickly, why it failed and the impact on Black America. The Freedman’s Bank offered a safe depository for formerly enslaved people, expanded quickly and gained millions in deposits – mostly ranging from $5 to $50. But inexperience and corruption doomed it to failure, costing may of the small depositors their savings.

- AvailablePaperbackGBP 19.95 Add to basket

- AvailablePDF

GBP 19.95GBP 9.97 Add to basket

A Decade of Armageddon

New Geography essays

This as-it-happened review of the causes, consequences, and repercussions of the 2008 Global Financial Crisis is more than a history lesson – it’s a look into the future.

These essays by Dr Susanne Trimbath, were first published between 2008 and 2015 on newgeography.com.

- AvailablePaperbackGBP 19.95 Add to basket

- AvailableHardbackGBP 39.95 Add to basket

- AvailablePDF

GBP 19.95GBP 9.97 Add to basket

The Work Revolution

Performance and Leadership in the Modern World

Through introspection and an awareness of our personality and character, The Work Revolution helps you develop practical tools and techniques to build a healthy approach to the modern working world.

- AvailablePaperbackGBP 19.95 Add to basket

- AvailablePDF

GBP 19.95GBP 9.97 Add to basket

The Tax Schedule

A Guide to Warranties and Indemnities (fourth edition)

The Tax Schedule explains the underlying rationale of the key provisions of the tax schedule, and provides updated model long-form and short-form warranties and tax indemnities.

The purpose of the book is to explain and simplify issues for tax advisors involved in transactions of buying and selling companies and business, enabling negotiations between tax advisors to keep sight of the commercial reality of the transaction (a sale by a willing seller to a willing buyer). The purpose of the tax schedule is to determine where responsibilities and risks will lie following the completion of the transaction, as well as to re-examine a number of so-called ‘market practices’.

- AvailablePaperbackGBP 65.00 Add to basket

- AvailableHardbackGBP 100.00 Add to basket

- AvailablePDF

GBP 100.00GBP 50.00 Add to basket

UK Taxation

a simplified guide for students 2023/24

- AvailablePaperbackGBP 37.50 Add to basket

- AvailablePDF

GBP 37.50GBP 18.75 Add to basket

Taxation of Small Businesses 2023/2024

The Taxation of Small Businesses 2023-24 is a practical guide to all aspects of direct taxation of small businesses in one volume. It is ideal for sole practitioners and small partnerships, but will be a handy reference guide for all tax advisers. The book aims to give a clear explanation of the relevant legislation and practical advice on ways of minimising clients’ tax liabilities and warning against common pitfalls.

The sixteenth edition has been updated to incorporate changes as a result of the Finance Act 2023.

- AvailablePaperbackGBP 60.00 Add to basket

- AvailablePDF

GBP 60.00GBP 30.00 Add to basket

Insurance Premium Tax - A user's guide

Insurance Premium Tax is a guide for practitioners and those involved in the insurance industry. It summarises how the IPT is applied in practice, the definition of an insurance contract, looks at exemptions from the tax, the application of the higher rate and issues affecting non UK risks and global policies. It also explores compliance issues such as IPT registration, the submission of returns and payment of the tax, changes in rates and the penalty regime.

- AvailablePaperbackGBP 65.00 Add to basket

- AvailablePDF

GBP 65.00GBP 32.50 Add to basket

Introduction to European Tax Law on Direct Taxation

Seventh edition

This handbook is a concise guide for all those who aim at obtaining a basic knowledge of European tax law. For students, it should also be useful for experienced international tax specialists with little knowledge of European law, European law specialists who need to understand the foundations of European tax law.

- AvailablePaperbackGBP 50.00 Add to basket

- AvailablePDF

GBP 50.00GBP 25.00 Add to basket

Employment Related Securities and Unlisted Companies

Fourth Edition

Employment-Related Securities and Unlisted Companies is written with mainly private or unlisted companies in mind and explains in depth how the employment related securities (‘ERS’) rules in ITEPA 2003, Part 7 apply to employee share acquisitions generally, including:

- Securities as earnings

- Restricted or convertible securities

- Securities acquired for less than market value

- Securities disposed of for more than their market value

- Post-acquisition benefits connected with securities

- Securities acquired under options

The book also explores employee share acquisitions through various means, the relevant capital gains tax rules and corporation tax relief for employee share acquisitions. Basic share valuation methodology is discussed and though PAYE and NICs do not apply generally to unlisted company shares/securities, they may apply where a market exists for the securities or on the occurrence of events related to ERS. Lastly, the compliance requirements with regard to online registration of schemes, annual returns, penalties etc, are also featured.

- AvailablePaperbackGBP 70.00 Add to basket

- AvailablePDF

GBP 70.00GBP 35.00 Add to basket

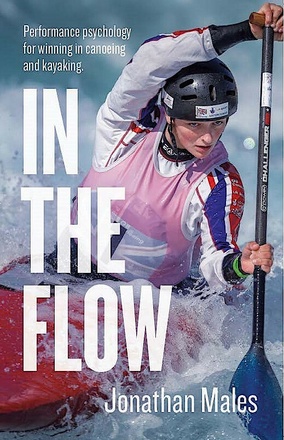

In The Flow

Performance psychology for winning in canoeing and kayaking

What’s the connection between what paddlers think and feel and how they perform? How does mental preparation help performance? What do paddlers and their coaches need to do, to ensure paddlers perform at their best when it counts?

Former international paddler and now sport psychologist Jonathan Males combines his many years of experience working with successful competitors with recent research in this accessible book, designed to help paddlers and coaches understand the theory behind success and provide practical skills to improve performance.The importance of delivering the psychological fundamentals to achieve paddling success. What's the connection between what paddlers think and feel and how they perform? How does mental preparation help performance? What do paddlers and their coaches need to do, to ensure paddlers perform at their best when it counts? Former international paddler and now sport psychologist Jonathan Males combines his many years of experience working with successful competitors with recent research in this accessible book, designed to help paddlers and coaches understand the theory behind success and provide practical skills to improve performance.

Relevant for competitors in all disciplines as well as for recreational paddlers, In the Flow features chapters on self-confidence, decision-making, teamwork, whitewater paddling, competition and the joys of wilderness paddling.

To listen to a sample of the audiobook click here

- AvailablePaperbackGBP 17.00 Add to basket

- AvailablePDF

GBP 10.00GBP 5.00 Add to basket - AvailableDownloadable audio fileGBP 4.95