ADR and Trusts An international guide to arbitration and mediation of trust disputes

Settling trust disputes without litigation can save all parties legal costs and maintain confidentiality (reducing the risk of unwelcome publicity). ADR and Trusts is a development from the authors’ accredited mediation training course for the Society of Trust and Estate Practitioners (STEP).

Part A introduces the reader to the different forms of dispute resolution, and examines the differences between arbitration and mediation of trust and fiduciary disputes.

Part B examines 27 jurisdictions and how trust law and ADR operates in each of them. Each profile addresses: arbitration law and practice, trust law, the mandatory requirements for mediation and the enforcement of ADR awards.

Mediators, arbitrators, trust and estate planning practitioners, trust managers and anyone involved in trust disputes should all benefit from reading this book.

- AvailablePaperbackGBP 99.95 Add to basket

- AvailablePDF

GBP 99.95GBP 49.98 Add to basket

Bess of Hardwick: An Elizabethan Tycoon

The life of Bess of Hardwick - one of the most remarkable people who lived in England in the late Tudor period. Her social ascendance from a relatively humble Midlands family to becoming the Countess of Shrewsbury.

Wyn Derbyshire describes how Bess navigated the political and legal challenges for her to retain her wealth and independence in the Tudor period.

Illustrated with colour pictures, the book also includes a timeline and family trees.

- AvailablePaperbackGBP 15.95 Add to basket

- AvailablePDF

GBP 15.95GBP 7.97 Add to basket

Charity Law Handbook

This is an indispensable collection of statutory and non-statutory materials relating to charity law in England and Wales. Revised to coincide with the implementation of the Charities Act 2011 – a major consolidation of the charity law - the Handbook is an essential reference source for charity lawyers, in-house lawyers, academics, charities and voluntary organisations and their trustees.

Available as three paperback volumes, CD-ROM or both (the mixed media option).

- AvailablePDF

GBP 99.95GBP 49.98 Add to basket

Childcare Choices and Costs

A practical guide to employment and tax issues

This book is primarily for parents looking for a source of information which compares the different types of childcare available in the UK. It provides information on the financial consequences, commitments and obligations that come with each of the different forms of childcare.

- AvailablePaperbackGBP 19.95 Add to basket

- AvailablePDF

GBP 19.95GBP 9.97 Add to basket

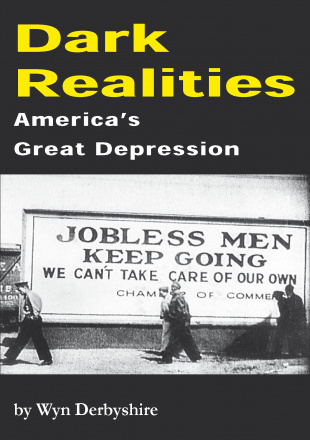

Dark Realities

America's Great Depression

This book covers the turbulent period of 1921 to 1942 in America's history, which went from the Roaring Twenties to the Great Depression and recovery via the New Deal. It introduces us to the key figures and reveals the impact which the Great Depression had on the American people.

Will be of value to GCSE, AS and A level history students looking for an accessible account of the Great Depression.

- AvailablePaperbackGBP 9.95 Add to basket

- AvailableHardbackGBP 17.95 Add to basket

- AvailablePDF

GBP 9.95GBP 4.97 Add to basket

A Decade of Armageddon

New Geography essays

This as-it-happened review of the causes, consequences, and repercussions of the 2008 Global Financial Crisis is more than a history lesson – it’s a look into the future.

These essays by Dr Susanne Trimbath, were first published between 2008 and 2015 on newgeography.com.

- AvailablePaperbackGBP 19.95 Add to basket

- AvailableHardbackGBP 39.95 Add to basket

- AvailablePDF

GBP 19.95GBP 9.97 Add to basket

The Employee Ownership Manual

This book is intended to meet a range of different needs and to cater for different levels of knowledge about employee ownership. If you are considering making your company employee-owned or you are advising someone going through that process, and in either case are new to the topic, you can build up your knowledge levels from Chapter 1. Alternatively, the book can be used as a reference work if you have a particular question to answer.

The book is intended as practical guide rather than a highly detailed technical treatise. Its priority is to explain key issues in an accessible fashion and to raise awareness of where further exploration and advice may be important.

- AvailablePaperbackGBP 49.95 Add to basket

- AvailablePDF

GBP 49.95GBP 24.98 Add to basket

Employee Reward Structures

Sixth edition

This is a comprehensive guide to the tax treatment of executive reward packages, from recruitment to termination. Includes a comprehensive glossary of terms, checklists and flowcharts.

The sixth edition contains analysis of: the following changes:

- Taxation of pensions contributions, cap on tax relief for contributions, additional rate relief restriction, alignment of pension input periods, reduction in lifetime allowance, freedom to draw down lump sums

- Termination payments Significant proposed changes in treatment

- Employee Benefit Trusts: Important case law developments (Murray Group Holdings)

- Employee Shareholder Shares: Changes to the relief and proposal to end agreements

- Employee Share Plans: Streamlining and Self-certification

- Benefits in kind: Removal of ‘lower-paid employee’ status

Includes complete work on CD-ROM (with cross-references and website resources hyperlinked) with the printed book.

- AvailablePaperbackGBP 125.00 Add to basket

- AvailablePDF

GBP 125.00GBP 62.50 Add to basket

Employment Related Securities and Unlisted Companies

Fourth Edition

Employment-Related Securities and Unlisted Companies is written with mainly private or unlisted companies in mind and explains in depth how the employment related securities (‘ERS’) rules in ITEPA 2003, Part 7 apply to employee share acquisitions generally, including:

- Securities as earnings

- Restricted or convertible securities

- Securities acquired for less than market value

- Securities disposed of for more than their market value

- Post-acquisition benefits connected with securities

- Securities acquired under options

The book also explores employee share acquisitions through various means, the relevant capital gains tax rules and corporation tax relief for employee share acquisitions. Basic share valuation methodology is discussed and though PAYE and NICs do not apply generally to unlisted company shares/securities, they may apply where a market exists for the securities or on the occurrence of events related to ERS. Lastly, the compliance requirements with regard to online registration of schemes, annual returns, penalties etc, are also featured.

- AvailablePaperbackGBP 70.00 Add to basket

- AvailablePDF

GBP 70.00GBP 35.00 Add to basket

Equality and Anti-Discrimination Law

The Equality Act 2010 and other anti-discrimination protections

Equality and Anti-Discrimination Law covers The Equality Act 2010 and other anti-discrimination protections both within the UK legislation and in the context of EU law.

As well as the Equality Act 2010, other key areas covered include atypical worker protection and family friendly regulation: each of these are discussed to sufficient detail to enable the reader to gain a working understanding of how each operates.The text takes account of case law from both UK courts, and European Courts where this is needed. This helps show the interaction that UK and EU law has in the area of equality law, and how the systems are interdependent.

- AvailablePaperbackGBP 34.95 Add to basket

- AvailablePDF

GBP 34.95GBP 17.48 Add to basket

European Employment Laws

A comparative guide

The book reviews the evolution of labour law within the EU, analyses the distinct regional approaches to employment and welfare, and looks at the pressures for change within a further enlarged EU. The authors then provide a basic outline of employment law in each of the 28 member states, and in Turkey, Montenegro and Bosnia Herzegovina (all of whom are preparing for membership). It is intended for HR persons, lawyers looking for basic knowledge, policymakers & lawmakers elsewhere in EU, and EU bodies.

- AvailablePaperbackGBP 59.95 Add to basket

- AvailablePDFGBP 59.95 Add to basket

The Glorification of Plunder

State, Power and Tax Policy

This book is about two things: tax and power.

This book explores the complex dynamics of the debates which inform tax policy, the interaction between tax and power and how power relations between various groups in society and between individuals and the state are manifested through tax system. This helps to explain why the rules, procedures and practices are all formulated to suit their interests of the most powerful groups in society.

- AvailablePaperbackGBP 19.95 Add to basket

- AvailablePDFGBP 9.99 Add to basket